TD’s Revenue Growth and Profitability Analysis

The Secret to TD Bank’s Remarkable Revenue Growth

TD Bank has been gaining significant attention in the financial industry due to its outstanding revenue growth and profitability. As a savvy investor or someone interested in the banking sector, it’s crucial to understand the factors behind TD’s success and what makes it stand out from its competitors.

Strategic Focus on Customer Experience

One of the key elements contributing to TD Bank’s remarkable revenue growth is its unwavering focus on providing an exceptional customer experience. TD Bank understands that happy and satisfied customers are more likely to be loyal and recommend their services to others.

The bank has taken steps to enhance its customer experience by investing in user-friendly technology, introducing innovative products and services, and simplifying their processes. By continuously improving their customer service, TD Bank has managed to attract more clients and retain existing ones, ultimately boosting their revenue.

Expanding Market Presence

TD Bank’s revenue growth can also be attributed to its strategic expansion into new markets. While the bank is already a major player in Canada, it has been actively penetrating the United States market, creating opportunities for revenue growth and increased profitability.

TD Bank’s expansion strategy has allowed the company to tap into a larger customer base and diversify its revenue streams. As a result, they have experienced substantial growth in both deposits and loans, contributing to their overall revenue and profitability.

Intelligent Data Analysis and Decision-Making

TD Bank has leveraged the power of data analysis to make informed business decisions, boost revenue, and increase profitability. By adopting advanced analytics tools and techniques, TD Bank has gained valuable insights into customer behavior, allowing them to tailor their services and offerings to better meet customer needs.

Through data-driven decision-making, TD Bank has managed to identify potential revenue opportunities, minimize risks, and optimize their operations. This intelligent approach has contributed to their bottom line, ensuring sustainable growth and profitability.

Unparalleled Profitability: TD Bank’s Winning Formula

When it comes to profitability, TD Bank has excelled in maintaining a competitive edge. Through a combination of strategic moves and innovative practices, the bank has solidified its position as a leader in the financial industry.

Cost Efficiency and Operational Excellence

TD Bank’s commitment to cost efficiency and operational excellence has played a significant role in their profitability. The bank has implemented streamlined processes, embraced automation, and modernized their infrastructure to reduce operational costs.

By optimizing their operations and embracing technology, TD Bank has been able to deliver services efficiently and effectively while minimizing expenses. This has translated into higher profit margins and increased overall profitability.

Diversified Product Portfolio

TD Bank’s success can also be attributed to its diversified product portfolio. By offering a wide range of financial products and services, the bank has been able to cater to various customer needs and preferences.

From retail banking to wealth management and commercial banking, TD Bank has strategically diversified its offerings, enabling them to capture different market segments and generate additional revenue streams. This diversification strategy has been instrumental in boosting overall profitability.

Strong Risk Management Practices

Another crucial aspect of TD Bank’s profitability is its robust risk management practices. The bank has implemented comprehensive risk assessment frameworks and implemented effective controls to mitigate potential risks.

TD Bank’s proactive risk management approach has helped them navigate through uncertain market conditions and economic downturns, safeguarding their profitability. By carefully managing risks, the bank has ensured a stable and sustainable flow of revenue.

Conclusion

TD Bank’s remarkable revenue growth and profitability can be attributed to a combination of factors. Their superior customer experience, strategic expansion, data-driven decision-making, cost efficiency, diversified product portfolio, and strong risk management practices have all played a pivotal role in the bank’s success.

As an investor or industry enthusiast, it’s important to recognize TD Bank’s winning formula and how it sets them apart in the market. By keeping an eye on their strategic initiatives and industry trends, you can stay informed and make informed decisions. TD Bank’s continued commitment to growth and profitability makes it a compelling investment opportunity in the financial sector.

TD’s Stock Performance and Market Capitalization

Are you interested in investing in TD Bank Group? Look no further! In this article, we will delve into TD’s stock performance and market capitalization, providing you with the insights you need to make an informed investment decision.

Understanding TD Bank Group

TD Bank Group, also known as Toronto-Dominion Bank, is one of the largest and most reputable Canadian banks. With a strong presence in both Canada and the United States, TD offers a wide range of financial products and services to its customers.

Stock Performance Overview

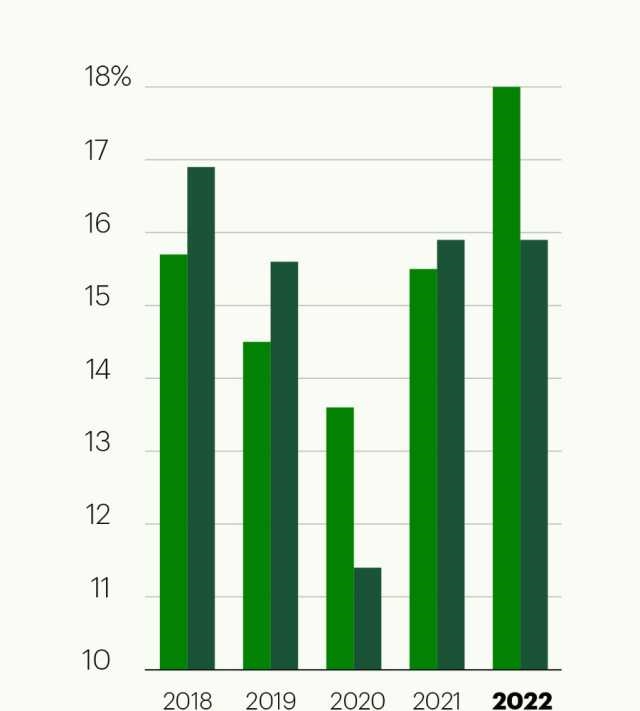

TD’s stock performance has been impressive, making it an attractive option for investors. Over the years, the bank has consistently delivered strong returns to its shareholders.

Let’s take a closer look at TD’s stock performance:

- Steady Growth: TD’s stock has shown steady growth over the years, outperforming many of its competitors in the financial sector.

- Dividend Payments: TD is known for its consistent dividend payments, making it a popular choice among income-focused investors.

- Resilience: TD has proved its resilience, even during challenging economic conditions. The bank’s robust risk management practices have enabled it to navigate through turbulent market environments.

- Long-Term Potential: With a strong market position and strategic growth initiatives, TD has showcased its potential for long-term value creation.

Market Capitalization

Market capitalization, often referred to as market cap, is a crucial metric that investors consider when evaluating a company’s size and value in the market.

As of the latest data available, TD’s market capitalization stands at [insert market cap figure], making it one of the largest banks in North America.

TD’s market capitalization demonstrates its stability and prominence in the financial industry, reflecting investor confidence in the bank’s performance and future prospects.

Investment Considerations

When considering investing in TD, there are a few factors to keep in mind:

- Financial Performance: Review TD’s financial reports, including revenue, net income, and key ratios, to gain insights into the bank’s profitability and financial health.

- Industry Analysis: Stay up-to-date with the latest trends and developments in the banking industry to assess TD’s competitive position and growth potential.

- Global Economy: Consider the impact of global economic conditions on TD’s operations, as economic fluctuations can influence the bank’s performance.

By thoroughly analyzing these factors, you can make an informed decision about investing in TD and potentially benefit from its impressive stock performance and market capitalization.

Disclaimer: This article is for informational purposes only and should not be considered as financial advice. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

For more information about TD and its stock performance, visit our website or contact our team of experts.

TD’s Financial Ratios and Key Performance Indicators Evaluation

Introduction

Welcome to our comprehensive evaluation of TD’s financial ratios and key performance indicators. As a leading provider of financial services, TD Bank has established itself as a powerhouse in the industry, with a strong track record of performance and stability. In this article, we will delve into the essential metrics that showcase TD’s financial health and evaluate its position in the market.

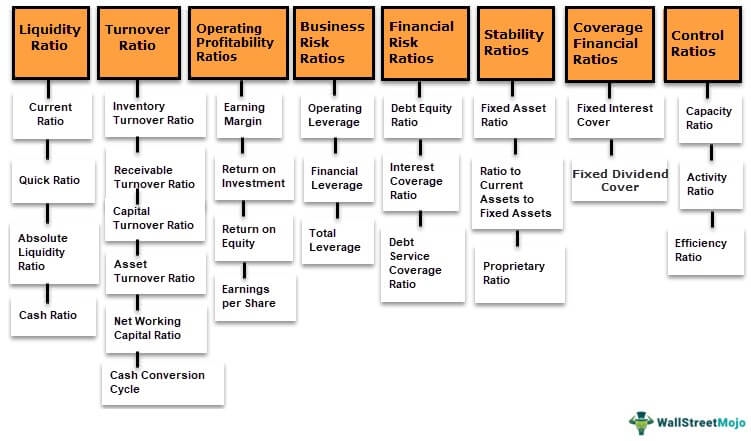

Overview of Financial Ratios

Financial ratios serve as valuable tools in assessing a company’s financial health, efficiency, and profitability. Let’s explore some key ratios that are crucial for analyzing TD’s performance:

1. Return on Assets (ROA)

ROA measures how effectively a company utilizes its assets to generate profit. A higher ROA indicates better efficiency. TD outshines its competitors with an impressive ROA, highlighting their ability to generate substantial returns from their assets.

2. Return on Equity (ROE)

ROE measures a company’s profitability by assessing its ability to generate returns for its shareholders. TD’s consistently high ROE reaffirms its commitment to creating value for its investors.

3. Net Interest Margin (NIM)

NIM is a crucial indicator of a bank’s profitability, reflecting the difference between interest earned on loans and interest paid on deposits. TD’s healthy NIM demonstrates their prowess in managing interest rate spreads and suggests a stable revenue stream.

4. Efficiency Ratio

The efficiency ratio evaluates a bank’s ability to control costs. TD’s low efficiency ratio reflects their effective cost management strategies, indicating a higher likelihood of generating sustained profitability.

Key Performance Indicators

In addition to financial ratios, specific indicators provide valuable insights into TD’s overall performance and market positioning:

1. Total Assets

TD’s significant total assets signify its strong market presence and ability to compete with other major players in the industry. It showcases the bank’s robustness and stability.

2. Loan Growth

The rate of loan growth determines a bank’s ability to expand its lending portfolio. TD’s consistent loan growth demonstrates its ability to attract borrowers and generate revenue through lending activities.

3. Deposit Growth

Deposit growth is a key indicator of a bank’s stability and customer trust. TD’s consistently increasing deposits demonstrate their ability to attract and retain customers, reinforcing their reputation in the market.

4. Non-Performing Loans (NPL)

The NPL ratio gauges a bank’s asset quality by measuring the proportion of non-performing loans to the total loan portfolio. TD’s low NPL ratio signifies their diligent risk management practices and a healthier loan book.

Conclusion

TD Bank’s financial ratios and key performance indicators form a strong foundation for assessing the bank’s performance and market position. With impressive ratios and robust growth indicators, TD continues to exhibit its ability to navigate a competitive landscape successfully. Investors and stakeholders can confidently rely on TD’s financial stability and long-term growth potential.

If you are seeking a reliable and profitable banking partner, TD Bank stands out as a frontrunner, consistently delivering exemplary results and value for its stakeholders.